Editor's Pick

अंतर्राष्ट्रीय सौर गठबंधन के बारे में जानिए | International Solar Alliance: Purpose, Membership & Goals

अंतर्राष्ट्रीय सौर गठबंधन (ISA) क्या है ?| Understand the International Solar Alliance.…

International

Discover Categories

World News

Health

Technology

Gadget

More Latest News

Winter Olympic 2022 : यूरोपियन यूनियन ने किया चीन के विंटर ओलंपिक का बहिस्कार : New Conflict

Winter Olympic : यूरोपियन यूनियन एक प्रस्ताव लेकर आई है जिसमे उसने चीन में आयोजित होने वाले का विंटर ओलंपिक (Winter Olympic 2022) का बहिस्कार किया गया है | चीन…

Acer Aspire 3 Laptop with First AMD Ryzen 7000 Processors in India launched

The Acer Aspire 3 is equipped with a powerful AMD Ryzen 5 7520 U Quad-Core Processor, which delivers fast performance…

Winter Olympic 2022 : यूरोपियन यूनियन ने किया चीन के विंटर ओलंपिक का बहिस्कार : New Conflict

Winter Olympic : यूरोपियन यूनियन एक प्रस्ताव लेकर आई है जिसमे उसने चीन में आयोजित होने वाले का विंटर ओलंपिक…

भारत-इजरायल संबंध |India-Israel Relations | Fresh New Prospective 2021

भारत-इजरायल संबंध की शुरूआत :The beginning of India-Israel relations भारत-इजरायल संबंध (India-Israel Relations) पुरातन काल से अच्छे रहे हैं पर…

FATF Blacklist : एफटीएफ क्या है? पाकिस्तान को ग्रे लिस्ट से मिलेगा छुटकारा या बढ़ी मुसीबतें | New Update 2021

एफटीएफ (Financial Action Task Force- FATF) आज इसकी बैठक होने वाली है. इस बैठक में आज फैसला होगा कि पाकिस्तान को ग्रे लिस्ट में रखा जाए या नहीं. बता दें…

भारत-म्यांमार का इतिहास ,संबंध और सामरिक महत्त्व: India Myanmar (Burma) relation, fresh new prospective 2021

भारत-म्यांमार का संबंध प्राचीन काल से ही बहुत अच्छा रहा है यहाँ तक की अंग्रेजो के भारत से जाने के…

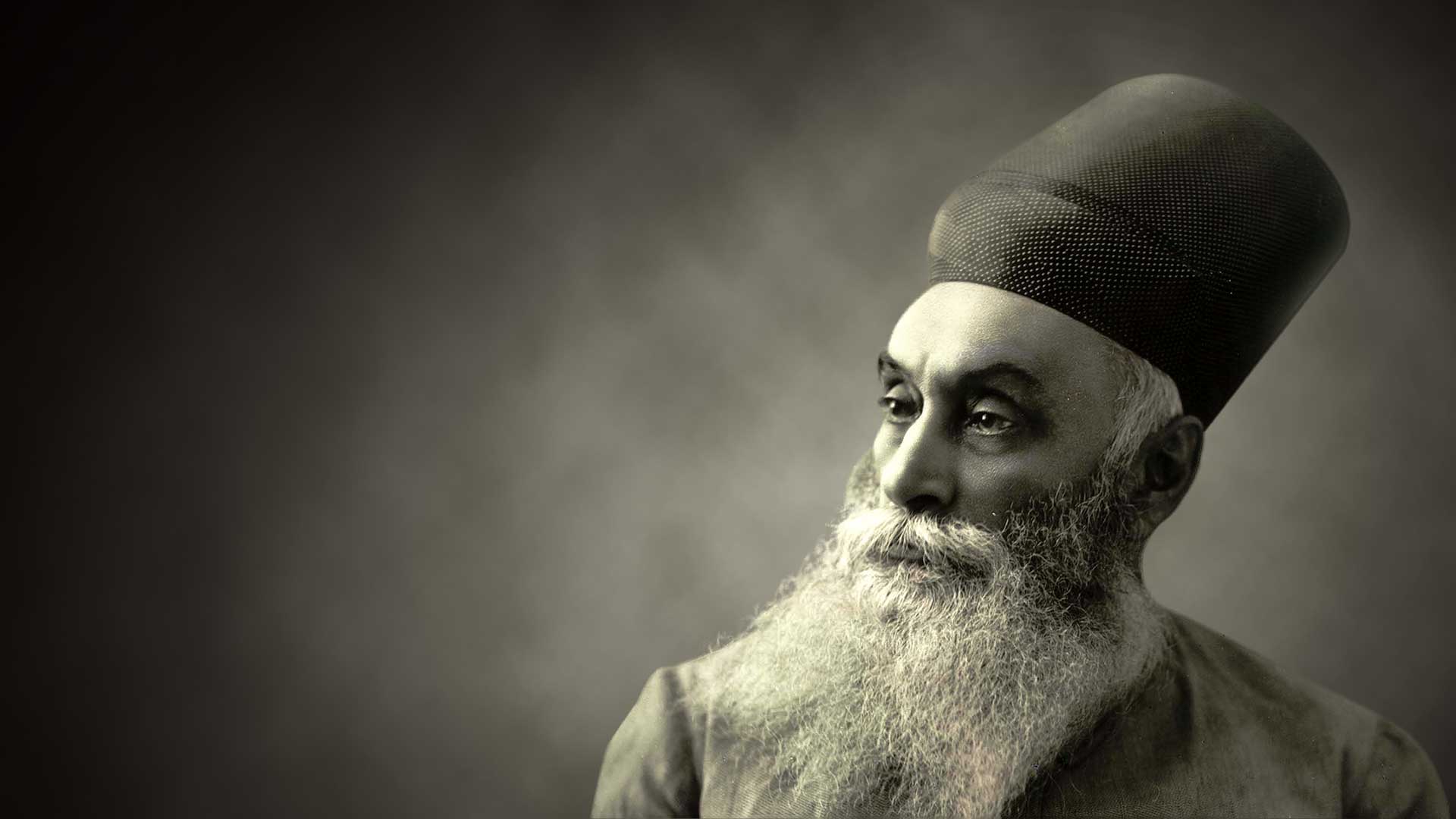

जमशेदजी टाटा (Jamsetji Tata) रूई से लेकर लोहे तक की पूरी कहानी पढ़िए: New 2021 Biography of Jamsetji Tata

संछिप्त परिचय (Short Introduction) जमशेदजी टाटा (Jamsetji Tata) मॉर्डन इंडिया के पहले उद्योगपति, जिन्होंने 1868 में टाटा समूह की नींव…

भारत-इजरायल संबंध |India-Israel Relations | Fresh New Prospective 2021

भारत-इजरायल संबंध की शुरूआत :The beginning of India-Israel relations भारत-इजरायल संबंध (India-Israel Relations) पुरातन काल से अच्छे रहे हैं पर…